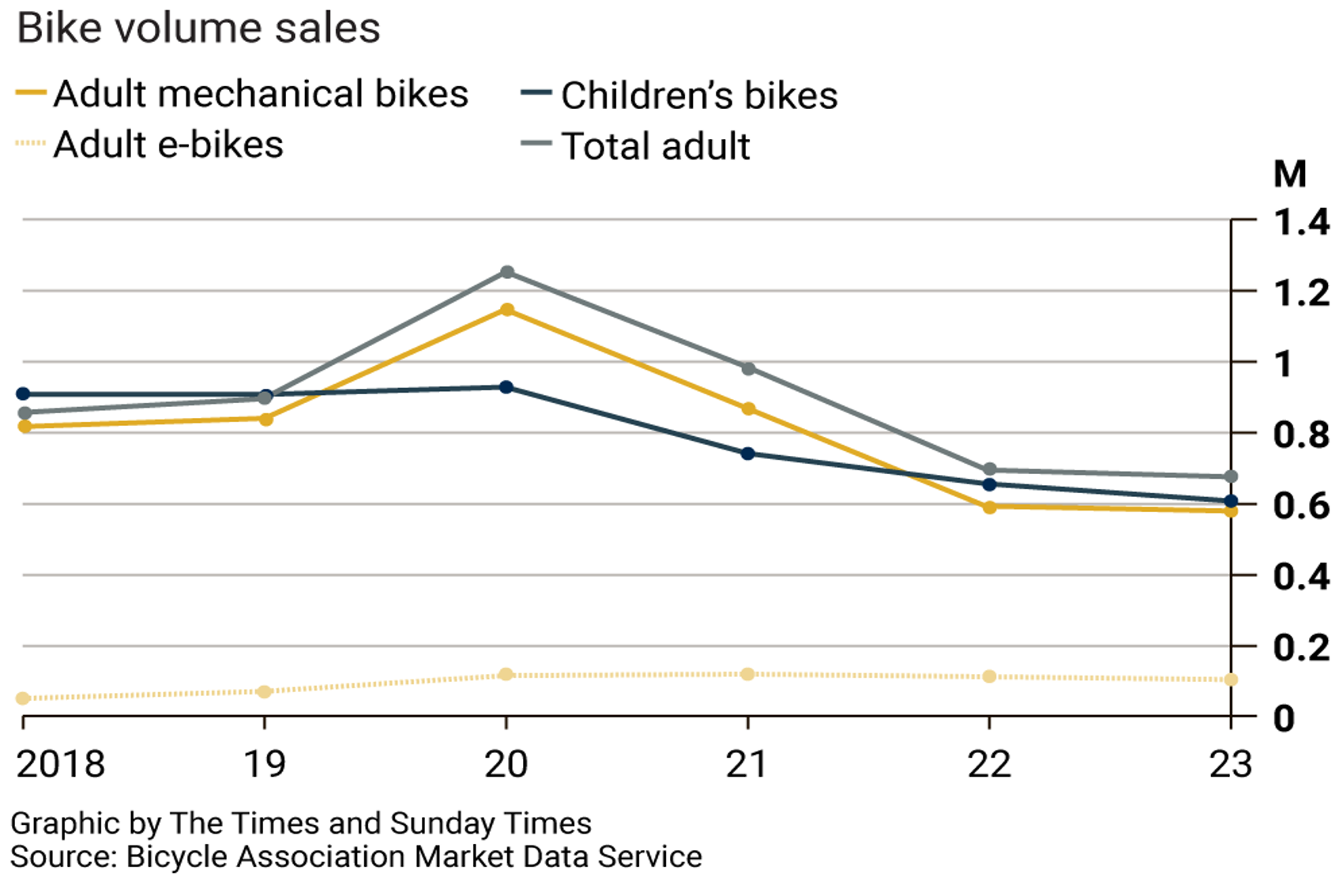

The pandemic transformed our travel habits – but not for long. After a surge in 2020, bike sales in 2023 were 33% below pre-pandemic levels, and the lowest in the UK since 1985.

New normal that never was

Covid-19 changed our behaviour forever…or did it?

Cazoo’s £6 billion valuation hinted that all car buying would be done online. But the company has now gone into administration, after generating losses of £700 million in 2022.

After the pandemic led to cruise ships being branded as “floating petri dishes,” 2024 saw a record number of passengers taking to the water for a holiday. Passenger numbers were up by 14.5% compared with 2019, which itself was a record year.

At the peak of Covid-19, we were told that e-commerce would transform the world. It turns out online shopping has followed the same growth trajectory it was on before the virus.

The pandemic was supposed to kill off gyms: who would want to pay when there were so many free alternatives at home? Yet 5 years on, gym memberships are at a record level (at least in the UK).

The pandemic killed the ability to travel overseas, but not the desire to do so. In 2024 a record number of passengers travelled through Heathrow airport (83.9 million), making the need for a third runway greater than ever.

Rolls Royce reported a £5.4 billion loss in the first half of 2020. Like many luxury car brands, the pandemic had wiped out demand – but it proved to be temporary. In 2023 it delivered more cars than any other year in its history, and its share price was up by 150% compared to before the pandemic.

The meteoric rise of Peloton suggested gyms were a thing of the past. Why travel to exercise when you could do it in your living room? Yet the company’s share price remains 97% below its 2020 peak, and it has recently started renting bikes to help shore up its losses.

Getir was valued at £9 billion in early 2022 – one of the many rapid delivery apps that thrived off pandemic restrictions. But two years later it exited the UK market, after the return to physical shopping meant it struggled to turn a profit (especially with competition from existing takeaway apps like Deliveroo).

The WFH genie is slowly going back in the bottle. The number of companies requiring employees to turn up three or more days a week rose from 67% in 2023 to 75% in 2024. Nearly one in three companies insist that employees are in the office for a full five days. And 83% of business leaders polled by KPMG, an auditor, say they expect a full return to the office by 2027.